The Truth About the City's Proposed Homestead Exemption Changes

In February, the City Council revealed some proposed changes to the property tax homestead exemptions offered by the City. The changes must be made through the Georgia General Assembly and signed by the Governor, who did so on May 1. These changes will appear on the City's ballot in November, and if approved, will take effect in 2024.

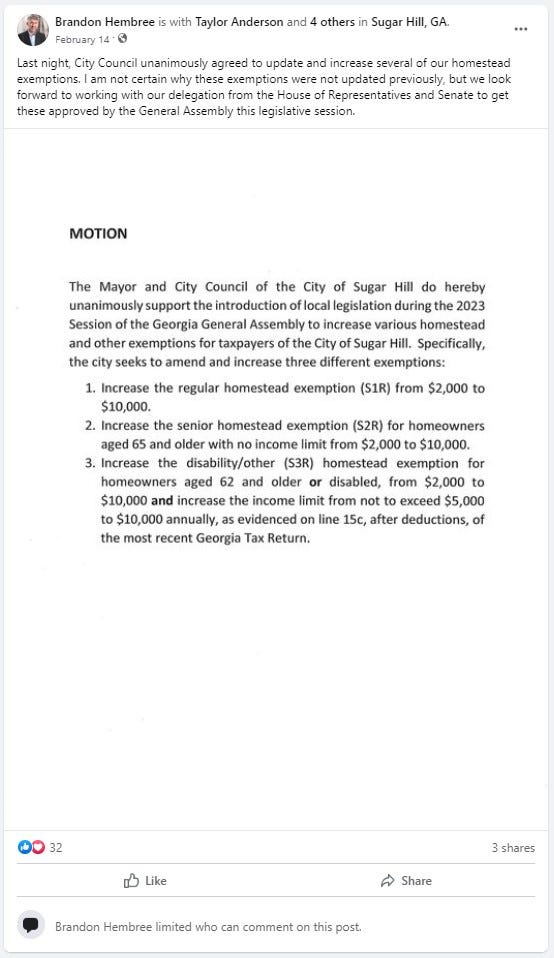

The fact that these changes will not apply to the current tax year was conveniently not mentioned during the City's presentation at the February meeting. Nor did Council Member Taylor Anderson mention it when he crowed about the changes on social media. Mayor Brandon Hembree also left it out of his initial social media announcement, only to mention it later, AFTER Curt Yeomans at Gwinnett Daily Post published an article that specified the truth about the proposed homestead exemption changes.

According to the City's presentation, and documented in the City's meeting minutes, the changes to the City of Sugar Hill Homestead Exemptions would be the following:

The regular homestead exemption (S1R) of $2000 will increase to $10,000.

The senior homestead exemption for seniors 65 and older (SR2) will increase from $2000 to $10000 and will no longer be subject to an income limit.

The exemption for people 62 and older (S3R) OR disabled will increase from $2000 to $10000 and the income limit will increase from $5000 to $10000 annually as shown on Line 15c, after deductions, of the most recent Georgia Income Tax Return.

I am all for saving the taxpayers some money, but the government of Sugar Hill has been noticeably oblivious to the issue for some years now.

So, I had to wonder, how much will taxpayers really save? Has our government finally felt some compassion for the hard-working taxpayers they've been squeezing especially hard recently, or is this just an election-year stunt to ensure a disgruntled electorate doesn't cut off their political careers?

How Does a Homestead Exemption Work?

A Homestead Exemption is subtracted from your home's taxable value before the tax calculation. It is NOT subtracted from your final tax bill. As such, the discount is far less than you might think.

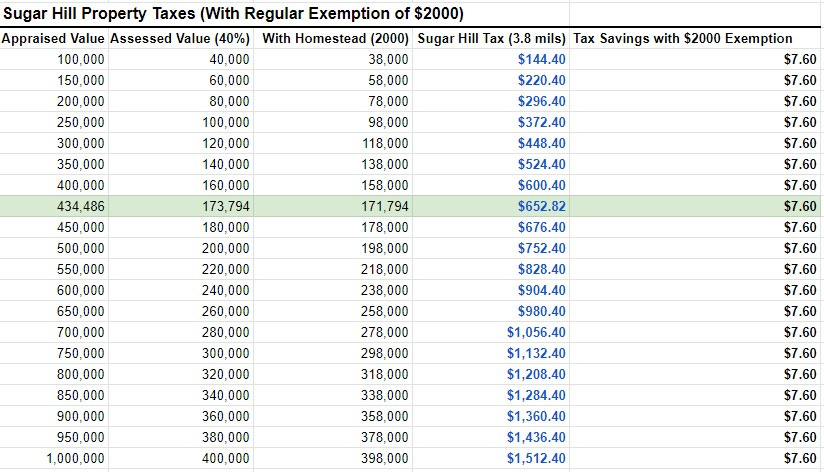

(Please note that the taxable value of your home (its assessed value) is 40% of its estimated market value (its appraised value). Georgia State Law specifies this, not the City of Sugar Hill.)

I calculated your Sugar Hill property taxes without the homestead exemption and with the S1R regular exemption of $2000, which is currently in effect and applies to the most people.

The savings of that exemption are only $𝟕.𝟔𝟎, regardless of the value of your home.

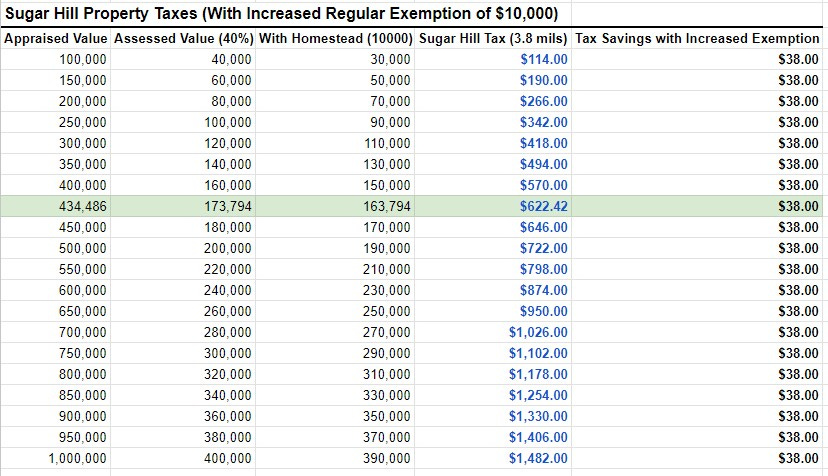

I also calculated your Sugar Hill property taxes with the $10,000 S1R regular exemption that would take effect next year if approved by voters this fall. The savings are $𝟑𝟖, regardless of the value of your home. So, the changes that the City so benevolently grants you would only save you an additional $𝟑𝟎.𝟒𝟎 over what you save now.

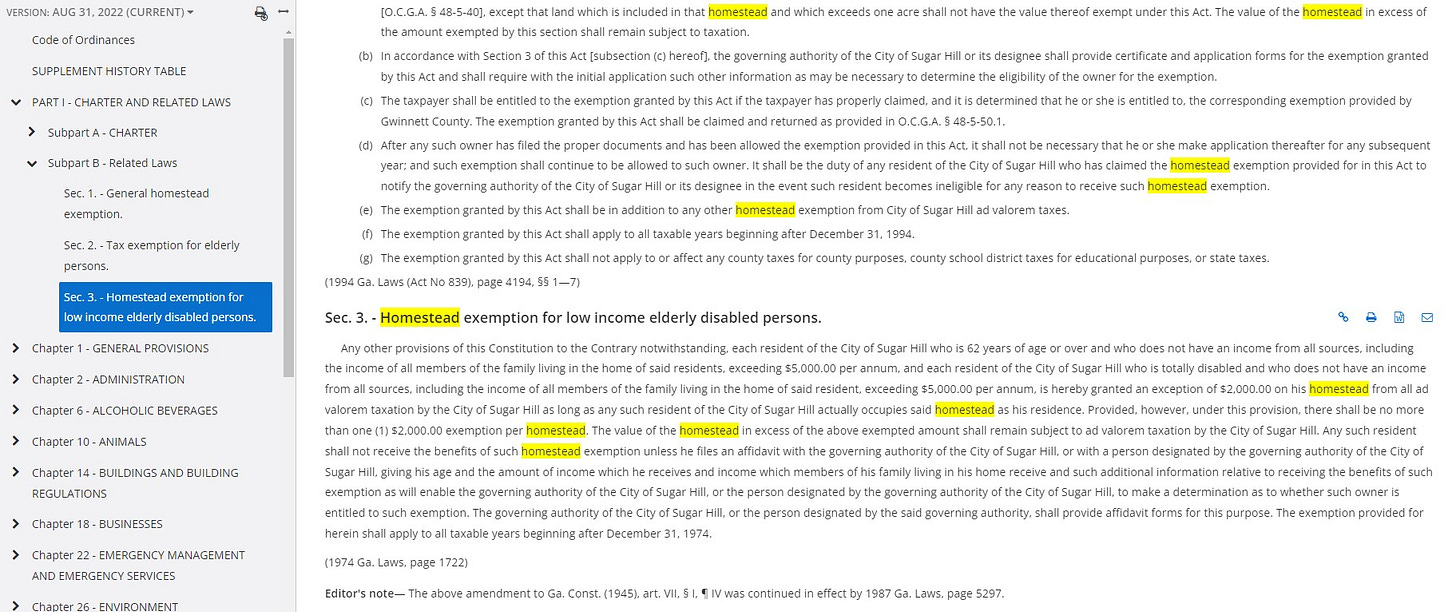

The homestead exemptions can be stacked, but not many people qualify for the other exemptions. According to the US Census Bureau, 8.6% of the Sugar population is 65 and older. The City claims that with their proposed changes, the senior Homestead Exemption would "no longer be subject to an income limit." When you look at the original ordinance, it was actually NEVER subject to an income limit. Saying they eliminated the income limit is purely election-year posturing.

It's a little harder to find statistics on the number of individuals in Sugar Hill who are 62 and older and disabled. The Census Bureau says 4.9% of the Sugar Hill population is under 65 with a disability. Disabled-World.com says that 7% of the Gwinnett County population of any age is disabled. From that standpoint alone, the exemption doesn't apply to many people.

When the City introduced these proposed changes to the public and said they generously wanted to raise the income limit for this exemption from $5000 to $10000, they failed to mention that the income limit applies to the entire household, not just the disabled individual. That's a severe limitation on the number of individuals qualifying for this exemption.

REAL Tax Savings

Last year, property assessments increased between 20 and 40 percent for most Sugar Hill residents, allowing the City of Sugar Hill to take in more than $5.6 million in tax revenue, an 31.15% increase in the previous year's tax revenue, even with the unchanged millage rate.

The City Council asked no questions of the City staff before their unanimous vote to keep the existing property tax rate. The City Council never publicly discussed and probably never even considered adopting the rollback rate. This change would have saved most taxpayers far more than these changes to the Homestead Exemptions.

The rollback rate is the millage rate that would offset the increases in property values and the amount of taxable property in the City, causing the City to take in the same revenue as it did the previous year.

The City is required by State Law to calculate the rollback rate prior to proposing its millage rate every year, and it is usually different every year.

This year's rollback rate hasn't been announced yet. Last year, it was 3.123 mills. To give you an idea of what a rollback can do, I calculated what the tax savings would be if the City adopted that rate.

Unlike the flat value savings with the Homestead Exemptions, the rollback rate saves people more depending on the value of their homes. Anyone with a home value of more than around $150,000 would have saved more than the general Homestead Exemption will save them. According to Zillow, the average home value in Sugar Hill is $434,486. A home with that value would save $𝟏𝟏𝟔.𝟑𝟎 on their Sugar Hill property taxes, substantial savings over that $38 the City is so generously giving you next year.

Also worth noting is that the rollback rate doesn't have to go through the General Assembly. All it takes is one City Council member to make the motion, another to second it, and three of the five to vote for it. It then goes into effect for the current tax year.

If the City adheres to its typical timing for the millage rate hearings and approval, it will unveil the rollback rate and its proposed millage rate in the next few weeks. Instead of the election-year posturing and sleight of hand we're getting with this Homestead Exemption, the City government finally needs to get real and enact some genuine relief for taxpayers.