The Curious Case of a Proposed ChurchPubEventCenter Complex

Is it really a church, or a business in disguise?

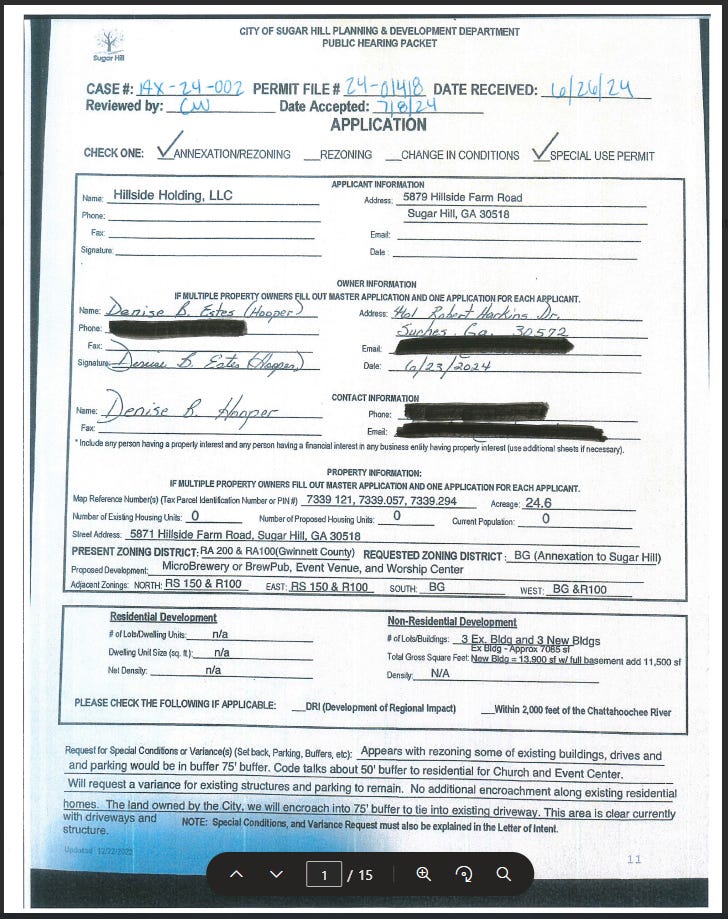

On Monday, August 19, the Sugar Hill Planning Commission will hold a public hearing to decide whether to recommend that the City Council approve case AX 24-002.

The City Council will make a final determination on the case at its next monthly meeting on Monday, September 9, at 7:30 PM at City Hall.

According to the signs at the site and the Planning Department Staff Report, AX 24-002 is for the annexation and rezoning of seven (7) parcels totaling 28.8 acres on Suwanee Dam and Riverside Roads behind the Publix shopping center.

According to the signs placed on the property, the applicant wants to annex and rezone the property from residential zonings RS-200 and RS-100 to BG (General Business), AF (Agricultural-Forest), and RS-100 (Medium-Density Single-Family Residential with a minimum lot size of ten thousand (10,000) square feet) for a “brewpub, event center, worship center, and residences.”

Real Deal Sugar Hill submitted Open Records Requests (ORRs) for a copy of the application as well as the Planning Department Staff Report for the case. Those documents are available for your review in their entirety at the end of the article.

Those documents reveal that there is a lot being crammed into this one case, there are many commonsense questions that haven’t been asked, and there are multiple holes in the story that is being told. It begs the obvious question of how and why this case ever made it through the Planning Department for consideration for approval by the City of Sugar Hill Planning Commission and City Council.

Annexation

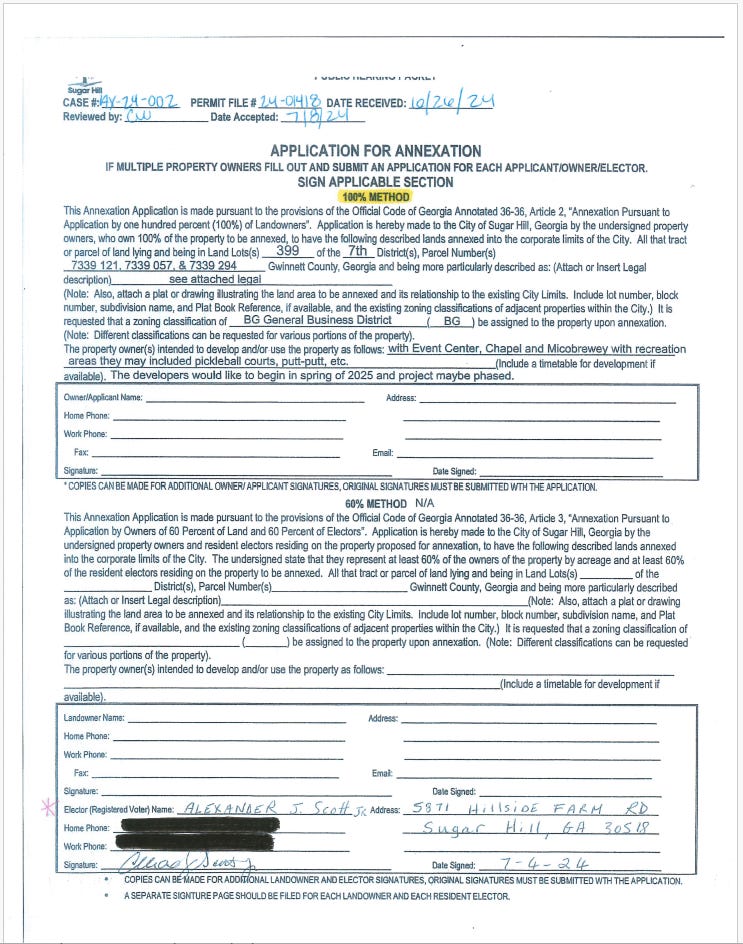

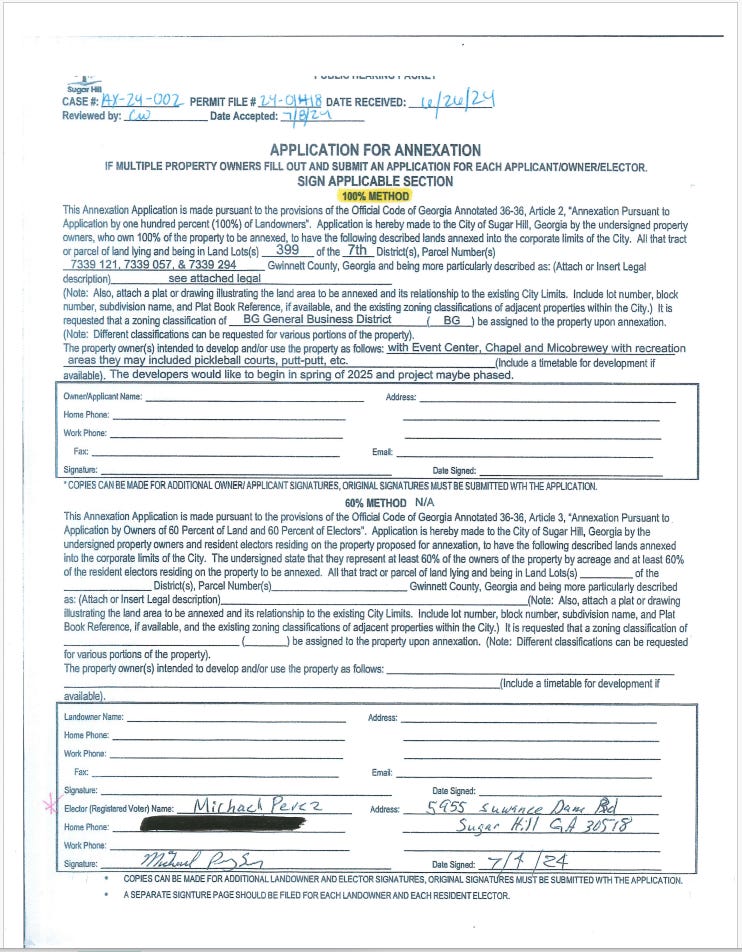

The holes all start with the annexation, which is logically the first step in this whole process, although it’s being lumped in with everything else as though it’s some small inconsequential thing. Typically, the annexation requests received by the City of Sugar Hill use the 100% method under Georgia Law, which allows all of the property owners of an area to apply for annexation by a City. That’s the most commonly observed form of annexation in the City of Sugar Hill.

The Staff Report for AX 24-002 states that the applicant is requesting the annexation of seven (7) parcels using the 60% method for annexation under Georgia Law. The 60% method allows people to request annexation into a City with a petition that has the signatures of the owners of 60% of the acreage and 60% of the electors living in the area to be annexed. The petition must clearly state the area to be annexed. If the City Council approves the annexation, they are required to adopt an annexing ordinance.

The full fourteen-page application filed by Hillside Holdings, LLC contains signatures for the property owners of three of the parcels (totaling 24 of the 28.8 acres) approving of the annexation. It also contains the signatures of 4 people who are supposed to be living on those parcels.

However, the application only mentions three of the seven parcels. The other four parcel numbers the City says that Hillside Holdings wants to have annexed are not mentioned anywhere in this application that the City provided to Real Deal Sugar Hill on August 9. Furthermore, those parcels are not even involved in this whole ChurchPubEventCenter project.

GA Code § 36-36-32(b) says the application “shall contain a complete description of the land proposed to be annexed.” Four parcels missing from the application doesn’t look like that at all.

Perhaps there is some other document floating around in the bowels of the Planning Department that contains all of the required info for the 60% annexation of these seven parcels in one document, as the law requires. But, the City should have turned that over in their response to the ORR.

Even if the City can weasel out of this on some legal technicality, good communications (ergo good public relations) dictate that there should be an associated application clearly indicating all of the parcels to be annexed, who exactly is applying for the annexation of those parcels, and why.

Two of the four parcels that are not listed in the application are owned by Georgia Transmission Corporation, which pays no taxes on the property. Those parcels would be an unincorporated island if the three parcels in the application were annexed, so it makes sense that the City would attempt to annex them as well, although there should still be an application somewhere that says all that. As for the other two out of the four, one is owned by a private individual who just purchased his parcel in July, and the other is owned by another LLC (that has since been dissolved). Those parcels would NOT form an unincorporated island if the City didn’t annex them, but those property owners will start owing Sugar Hill property taxes if the annexation is approved.

Just as good communications and public relations dictate that you have a clear and specific paper trail regarding any annexation, they also dictate that if you’re going to annex anyone without their permission by allowing their neighbors to steamroll them and force them under an additional layer of government (and all the taxes that come with that), you give them the courtesy of a dedicated zoning case and hearing for that steamrolling.

The City’s behavior regarding this case should concern ALL of Sugar Hill’s neighbors.

Rezoning

The applicant’s letter of intent states that the development will consist of an “event center, chapel, and microbrewery” and that “some of the existing homes will be retained and repurposed to accommodate these plans.”

Variances

While the signs do not indicate the variance request, the applicant is seeking two variances to the City of Sugar Hill Zoning Ordinance.

One variance is for a house (obviously built with residential requirements) that they claim is “approximately 60 feet” from the property line it shares with Emerald Lakes. It will be inside the 75-foot buffer required for BG if rezoning is allowed. Nothing in the application or letter of intent says what that house will be used for if the rezoning happens. By virtue of the BG rezoning and the fact that the site plan they submitted calls for eleven parking spaces to be added next to the structure, it’s safe to assume that they plan to use the “house” for some business purpose. With BG zoning, that purpose can easily change and grow larger (and more noisy) with time.

The second variance is for a cabin and driveway on another one of the applicant’s parcels that “are within approximately 15’ from the property line” of a parcel owned by the City of Sugar Hill that has “a recreation future land use designation” according to the Planning Department Staff Report. While the Letter of Intent claims that property is “approximately 15’ ” from the property line, they’re significantly lowballing that estimated distance. The structure sits just at or slightly beyond the 75-foot buffer distance required for BG.

Site Plan

The applicant’s site plan is difficult to make sense of because it zooms in super close on the project, is not oriented north-side up, and does not include any of the surrounding roads. It also includes a montage of random photographs that are apparently just for decoration because they don’t lend much to the document’s clarity.

Real Deal Sugar Hill rotated the site plan for your review with the north side up, just as you would see it in the Gwinnett GIS (or almost any other map in the world). The image from Gwinnett GIS is shown alongside that image for perspective on where the proposed site plan lies in relation to area roads, the adjacent Publix shopping center, and the neighboring Emerald Lakes subdivision.

The site plan for the ChurchPubEventCenter only involves two of the three parcels that the applicant wants to rezone from residential to BG. The application and site plan do not show any current purpose for rezoning the 4.35-acre, westernmost parcel that is directly off Suwanee Dam Road. However, a BG zoning opens up a lot of future possibilities that the City of Sugar Hill would be more limited in its ability to restrict.

The fourteen-page application says that the applicant is requesting three (3) new buildings and proceeds to state that the “New Bldg = 13,900 sf with full basement add 11,500 sf” without breaking down the sizes of each of the new buildings.

The site plan shows the three new buildings:

A chapel with one story and 2400 square feet.

An event venue with one story and 6200 square feet.

A microbrewery with two stories and 4500 square feet.

For people who like numbers and mathematics (that doesn’t seem to be the applicant or anyone who works at the City), that actually comes out to a total of 13,100 square feet. If there’s a total of 11,500 square feet of “full basement” for the new buildings, it appears all of the buildings are also getting basements, but the applicant is not specific.

Special-Use Permit

While the applicant checked the blank for “Special Use Permit” on the application, neither the application nor the Letter of Intent indicate why they’re requesting a special-use permit from the City.

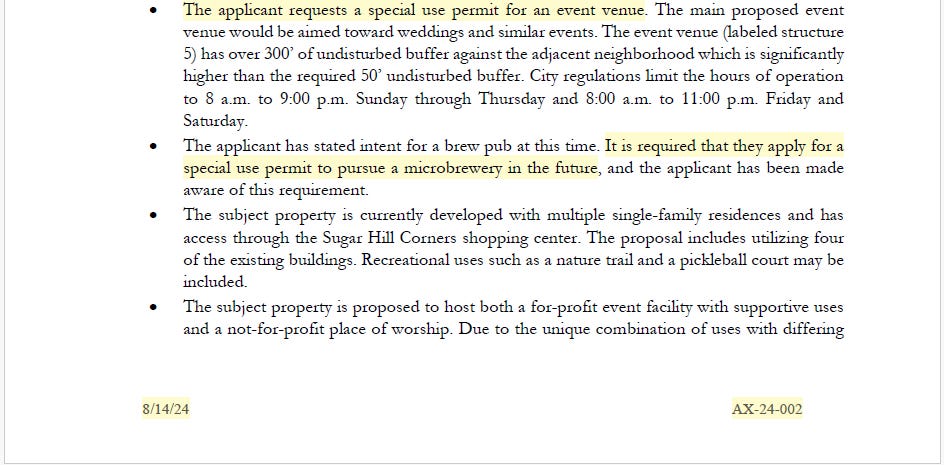

The City’s Staff Report indicates that they are requesting a special-use permit for an event venue. It’s unclear if they just need the permit to even have an event venue, or if they are potentially requesting different hours of operation than City regulations typically allow.

The Staff Report also indicates that the applicant is requesting a special-use permit for a microbrewery.

Who is “The Applicant?”

Throughout the article, references have been made to “the applicant.”

So, who is this mysterious applicant?

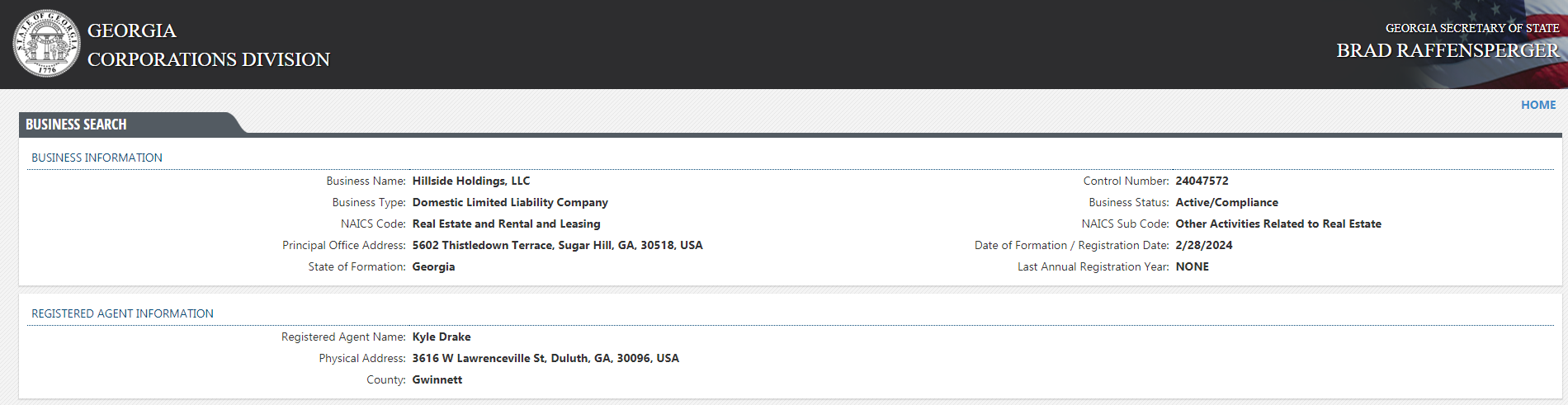

The name provided on all 14 pages of the application, the Letter of Intent from the Applicant, and in the City’s Staff Report is “Hillside Holding, LLC.” Notice that’s “Holding” and not “HoldingS” with an ‘S’.

A search of the Georgia Secretary of State database reveals there is no “Hillside Holding, LLC” in Georgia, but there is a ‘Hillside Holdings, LLC".

So why did the applicant consistently misspell their own name? It’s a small error that actually does thwart a basic Google search. That’s usually the first search, and often the only search, average curious citizens will conduct. Of course, the applicant could just be dumb. The multiple problems (grammar and otherwise) in the parts of the application they filled out lend credence to that possibility.

According to the database, the one active Hillside Holdings, LLC is located in Sugar Hill, GA on 5602 Thistledown Terrace.

Tax-Exempt Status

The same address of 5602 Thistledown Terrace is home to “Good News Church Georgia Limited,” a Domestic Nonprofit Corporation and religious organization, according to the Secretary of State corporations database. Drue Warner serves as the CFO, CEO, and Secretary of the organization.

Warner also applied for and received a 501(c)(3) exemption from federal income taxes from the Internal Revenue Service for Good News Church Georgia Limited in 2021. The 501(c)(3) determination from the IRS also makes Good News Church exempt from Georgia’s corporate income taxes.

The tax-exempt status appears to still be in effect, according to the IRS website. Good News Church Georgia Limited has filled out a form 990-N (required by the IRS to retain the 501(c)(3) tax-exempt status) for 2021, 2022, and 2023.

Interestingly, the name of the church was misspelled on the 2021 form. All of the forms indicate that Good News Church normally had gross receipts of not more than $50,000. Whether that’s 49 cents or $49,999 - the IRS doesn’t seem to know.

Who/What is “Good News Church?”

In reading more about the church, it becomes obvious why Warner is requesting the rezoning for the unusual combination of a brewpub, event center, and worship center.

It also becomes obvious why he never shares the website URL (goodnewschurchga.com) with the IRS when he submits Form 990-N.

The first page of the website shows where they’re meeting. This Sunday, and for many recent Sundays, they’ve been meeting at Elixir Brew in Buford. Another common meeting site, and the place where they started meeting in 2021, is Monkey Wrench Brewing in Suwanee. They usually meet at 10 AM, before the breweries are open to the public and allowed to sell alcohol (12:30 PM on Sundays per State law).

Church attendees then stick around for beers. Monkey Wrench regularly hosts food trucks so people can also eat. Although there are restaurants nearby, Elixir Brew has no food menu of its own. In one case, Warner posted on Facebook that Good News Church had an open tab for three hours and bought beer and pizza for people. The post doesn’t explain specifically who paid for the open tab. Was this coming out of Warner’s own pocket, out of Good News Church funds, or some other source?

A recent church newsletter indicates that Good News Church also plans to start meeting at Elixir Brew for a special video series on Monday nights starting in September.

It all seems like a pretty sweet deal for Monkey Wrench and Elixir, who are getting extra business (and $$) through the arrangement. Are they compensating Warner for that assistance? There’s no way to know if they are, and if so, how they’re providing the compensation.

Good News Church isn’t the least bit shy about its fundraising efforts, which are prominently featured in several church newsletters obtained by Real Deal Sugar Hill. Apparently, Good News Church has set up multiple ways of donating, and even points out that Good News Church has a 501(c)(3) tax exemption from the IRS, making all contributions tax deductible.

In an end-of-year newsletter from their first year, 2021, Warner describes his “vision,” which is probably an indication of what he wants to do with this property behind Publix. He says,

“Our long-term plan is to eventually have our own space that would be a popular gathering spot throughout the week for people in our community. We envision fresh [sic] roasted coffee, locally crafted beer on tap, locally produced wine, handmade arts, crafts, foods, and gifts for sale, as well as indoor and outdoor spaces for large and small events (i.e., weddings, receptions, men’s, and women’s groups, etc.).”

The word “church” never appears in his description of his dream, although he continues,

”We’d love to help start churches like this all over the country. We had a recent conversation with another local brewery owner who said he’d love for someone to start a church like ours in his brewery.”

It figures, given the extra boost in business it provides.

Warner said he got the idea for his dream at a ministry workshop when someone asked him, “If you knew you couldn’t fail, what would you do?” Warner’s answer was that “he’d open a brewery that also functioned as a church.” It’s interesting that, yet again, in his own words, Warner mentions the profit-driven business part first, and the church comes second.

In the website, the social media posts, and the newsletters, Warner also mentions different charity initiatives of Good News Church Georgia, obviously hoping everyone will focus on that. But how much money goes to charity as opposed to keeping up the church (including salaries) and growing it?

He states in that end-of-year newsletter from 2021 that “Our projected annual budget is $400,000, which includes mercy, outreach, overhead, salaries, and an investment in our future location.” He further says that “$37,850 (28% of all contributions) has been given to mercy and outreach ministry needs.” That would mean that from April until November of 2021, just part of that first year, Good News Church took in $135,179.

Those numbers just don’t show this as mostly a charity operation, as you’d expect from a church. In fact, it looks a little more like the politicians’ age-old tactic of employing photo ops and shows of altruism as a fancy distraction.

Making a Decision

The Planning Department’s Staff Report briefly mentions the juxtaposition of highly taxable and tax-exempt property purposes. It says that “staff has requested that the applicant present the proposed tax liability for the property to ensure proper identification for tax purposes.”

It’s not clear exactly what they even mean by that, or if the applicant has yet provided any documentation to the City in response to that request. As of this article’s publication date, the City has shared nothing like that with the public.

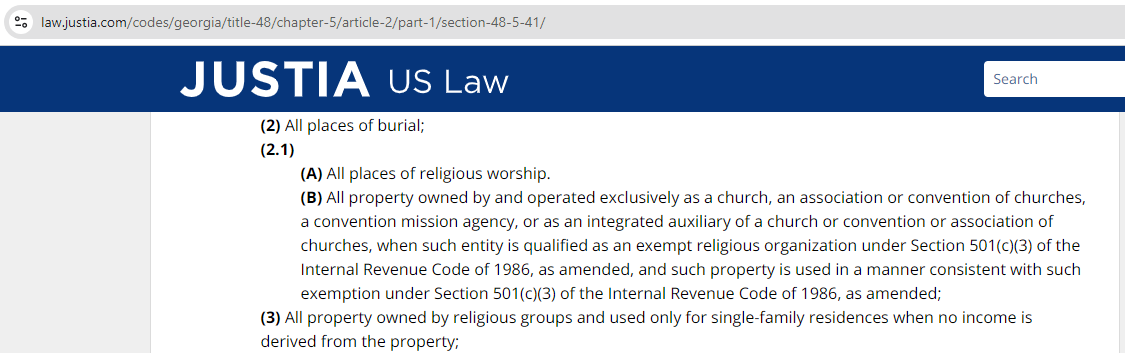

Furthermore, although Warner’s business interest, Hillside Holdings, LLC is applying for the annexation and rezoning, none of the property affected by that request has been sold yet. It remains to be seen whose name the property will be in or whether the parcels will be subdivided to create some separation between the commercial ventures and the church. It is important to note that “All property owned by and operated exclusively as a church” is exempt from ad valorem property taxes under GA Code § 48-5-41(a)(2.1).

What is already abundantly clear (unless you have those special Sugar Hill government blinders on) is that this entire ChurchPubEventCenters setup provides ample means to circumvent the law and taxes easily without much chance of detection, even if someone were on the premises every day watching everything - not that the IRS, the State of Georgia, or the City of Sugar Hill will be.

If the City of Sugar Hill approves it, there will be a precedent set for more dubious entities just like it in Sugar Hill, and beyond.

Supporting Documentation

Good News Church Georgia End-of-Year Newsletters