Sugar Hill City Manager Tops List as Highest Paid in Gwinnett County

While state law mandates that the salary of public employees be public, if you ask for that information, governments typically just tell you a number and do not provide documentation to support the number.

Real Deal Sugar Hill has requested salary information for City Manager Paul Radford in the past and noticed that the number provided by the City did not match the numbers provided by other groups performing salary surveys. The other groups did not respond to requests from Real Deal about how they got their information, so there was no way to account for the discrepancy. It was never clear what documents they requested (if any) and whether they were looking at gross or net salaries or including car and phone allowances.

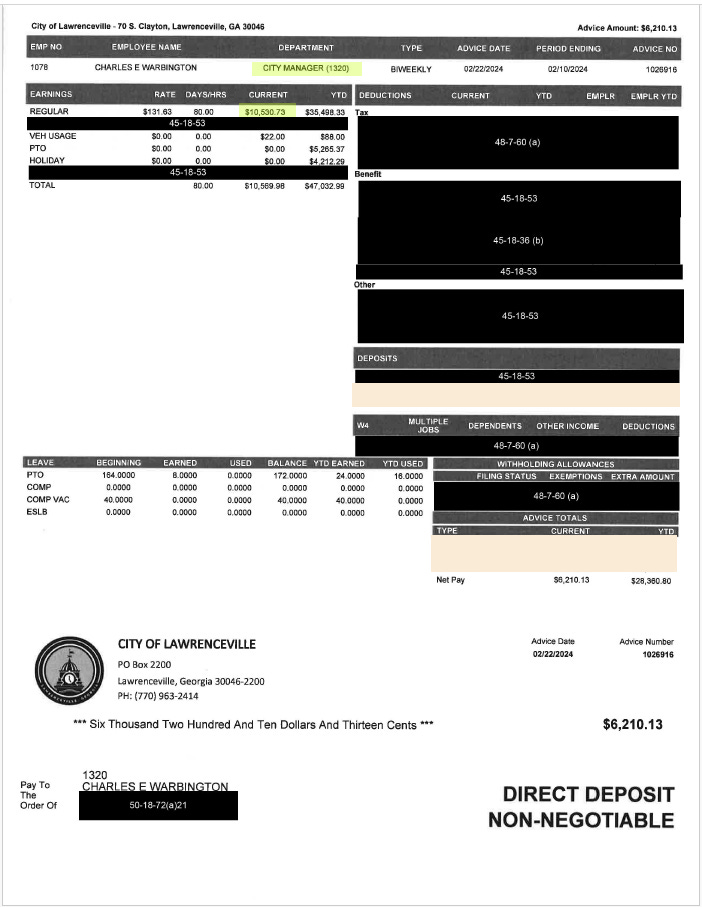

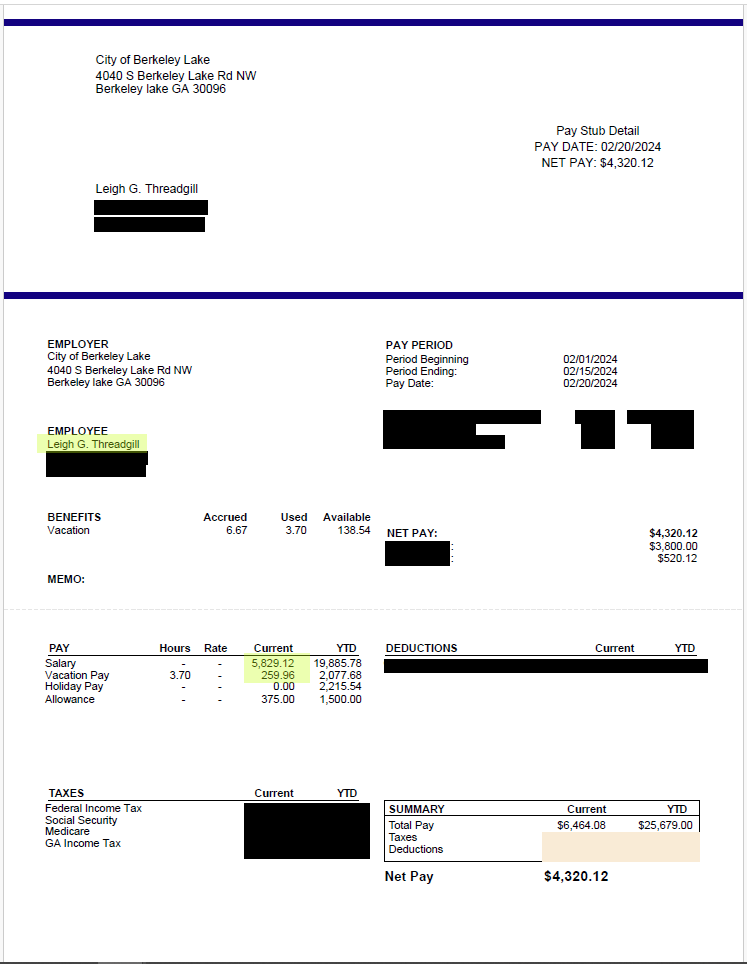

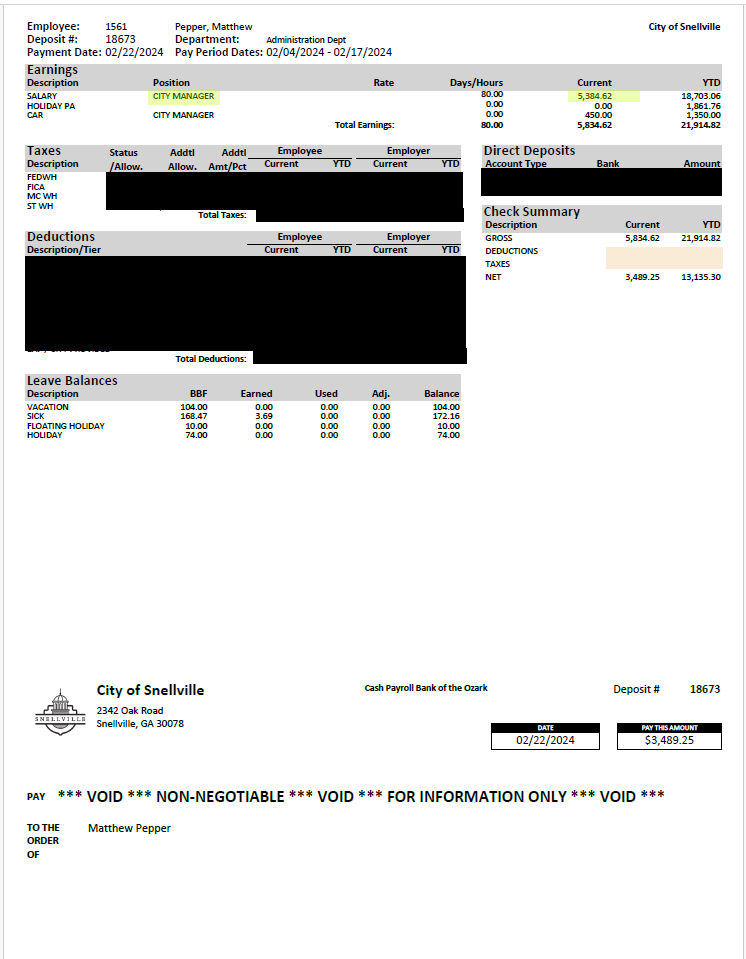

In most cases, though, government checks are subject to disclosure—with some redactions. So to clear up the confusion, compare everyone on equal footing, and get the real story, Real Deal Sugar Hill recently submitted Open Records Requests to all sixteen cities in Gwinnett County, asking for the most recent paycheck with check stub for the City Manager/City Administrator. RDSH then compared the gross salaries of all those individuals.

The survey reveals that City Manager Paul Radford of Sugar Hill is the most highly paid City Manager in Gwinnett County, with a gross annual salary of $284,481.60.

The values in this table only include the actual gross salary (not an adjusted gross for tax purposes) for each city manager. They do not include vehicle and cell phone allowances, vacation buyouts, the value of leave time accrued, or retirement benefits, even though you can see those in many of the check stubs. Georgia Law allows governments to withhold information about an individual employee’s retirement plans and medical/dental plans, even when those benefits are funded either partially or entirely by taxpayers.

You can, however, obtain an idea of the compensation he receives in the form of retirement benefits by reviewing the meeting minutes. Apparently, his salary increases are subject to a public vote, although the votes are always taken following Executive Session after most meeting attendees have left the building. Prior to 2019, when your representative from Real Deal started monitoring meetings, there probably would have been no one from the public in the room when these votes were taken.

In December 2014:

In December 2015:

In January 2016:

In January 2020:

In December 2021:

The City of Sugar Hill also has a pension plan for employees, elected officials, and appointees. It specifically chose to grant the City Manager role an exemption from participation in the pension plan, so it’s not clear if he is participating or not.

Radford’s employment contract with the City of Sugar Hill indicates that he began the role of City Manager in November 2013 (although he didn’t attend meetings as the official City Manager until July 2014) with a salary of $149,000 annually. This means that his salary has increased a little more than 90% in about ten years with the City.

In addition to his salary, the City agreed to provide a vehicle and phone allowance and pay for his memberships in professional organizations and one civic organization. Although it seems it would be the standard practice to pay for work-related travel for any City employee, Radford’s contract contains specific details about the amount of travel they are required to cover for him, which seems to indicate his work-related travel exceeds that of other employees or that he is granted more autonomous discretion than most employees about what constitutes work-related travel. The City also agreed to pay for his relocation expenses if he moved either inside the Sugar Hill City Limits ($7,500) or within fifteen (15) miles of the City Limits but not inside another city (($5,000). Twelve months later, however, they amended the contract and increased his relocation allowance to $50,000 in the first year (2015), $35,000 in the second year (2016), and $25,000 in the third year (2017).

The Contract also states that if the City of Sugar Hill fires him for anything other than arrest and/or conviction of a crime or professional misconduct, he’s entitled to termination pay equal to six (6) months of his base salary, plus an undisclosed amount. The City is also not allowed to reduce his salary, compensation, or any financial benefits while he’s there, unless they are also reducing the compensation of every other employee with the City of Sugar Hill.

Paul Radford’s Employment Contract with the City of Sugar Hill

Notes About the Survey

The City of Sugar Hill was the primary reason for the survey, so originally, I was not going to publish the actual checks from the other municipalities. I just wanted to see them to ensure accuracy and consistency for the comparison.

After much consideration, I decided it was in the readers' best interest to see everything.

First, Real Deal Sugar Hill's extensive proof and documentation differentiate it from the imitators.

Second, while this started as a home-grown Sugar Hill effort, there are now many Real Deal Sugar Hill readers beyond our City limits. I gratefully acknowledge their support and hope to provide them with relevant information whenever I can.

And last, I’ve become vaguely aware of some rumors and obfuscatory disinformation claiming that some other cities’ managers are making much higher salaries than the Sugar Hill City Manager is. That is demonstrably false. Should the people in those other municipalities judge their employees’ salaries, they should at least be evaluating the truth and not some rumor originating from whispers or from the silliness Nextdoor. That’s only fair to those communities and employees. If Sugar Hill government officials and their mouthpieces are as concerned about truth and fairness as they claim, I am sure they will support my efforts to correct these rumors.

Getting the Information

While these checks and check stubs are subject to disclosure under Georgia’s Open Records laws, the government must redact certain information. When they redact, they are required to cite the statute that requires or allows the redaction.

In some cases, the cities didn’t do this completely correctly. Some did not cite the statutes. The City of Auburn only responded once the Georgia Attorney General’s office intervened. The City of Norcross failed to respond initially and only did so when I informed them that I had reported them to the Georgia Attorney General’s office. They then incorrectly redacted paid leave and vehicle and phone allowances and cited a statute that didn’t apply in an attempt to cover themselves. Several more required a level of hounding and written forcefulness that I have NEVER had to apply to the City Clerk at Sugar Hill.

An employee at one city redacted nothing and actually gave me their city manager’s social security number and provided me with the routing and account number for that city’s bank account. I am all for openness, but this made me uncomfortable. I contacted that city’s attorneys so they can ensure the employee gets the proper training to protect this sensitive information for their benefit, and for mine.

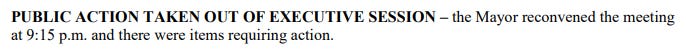

The City of Lawrenceville, the County Seat of Gwinnett, is the model for how everyone should have handled the request. I submitted the request on Friday, March 23, at about 12:30 PM and had a response by Monday at about 3:30 PM. The response included everything I asked for, and the relevant statute for each redaction was written on top of each redaction. They took it one step further and actually provided a table with every statute they used, how many times they used it, and a brief synopsis of each one.

For those who are curious, I submitted my request to the City of Sugar Hill on Wednesday, February 21, at about 1:30 PM. A few hours later, the City Clerk responded that they would get the information but that it would require redaction, which I expected. I received the check stub from the city clerk on February 26. They did everything properly.

In some cases, the City Managers responded to the ORR themselves and openly showed me their own checks. I’m not going to reveal those individuals for their protection, but I’d like to gratefully acknowledge the refreshing candor that I was happy to find within this County. While the public won’t know who you are, I do. And as much as this watchdog happily hounds bad government officials, I will just as aggressively guard open and honest ones should you ever require that.

About the Redactions

Redactions in black were made either by the cities themselves, or are additional redactions made by Real Deal Sugar Hill in an effort to comply with State laws against revealing certain information about government employees. Redactions in peach were made at the discretion of Real Deal Sugar Hill to further ensure the privacy of these individuals.

To the best of Real Deal’s knowledge, the statutes for these redactions are:

O.C.G.A. 45-18-36(b) (2010) “Records of participation agreements, payroll deductions, investment options, and other individual account information shall be maintained as confidential by the administrator. The records shall not be disclosed except as necessary to accomplish the purposes of this article or in cases where a subpoena has been issued for the purpose of discovery or as otherwise authorized in writing by the employee. This prohibition shall not bar federal, state, or local tax authorities from such access to the records as may be necessary to establish the tax status or liability of a participating employee.”

GA Code § 45-18-53(b) (2022) “Records of benefit selections, payroll deductions, and other individual account information shall be maintained as confidential by the flexible benefit plan...”

GA Code § 48-7-60 (2022) “Except in accordance with proper judicial order or as otherwise provided by law, it is unlawful for the commissioner, other officer, employee, or agent, or any former officer, employee, or agent to divulge or make known in any manner the amount of income or any particulars set forth or disclosed in any report or return required under the law of this state or any return or return information required by the Internal Revenue Code when the information or return is received from the Internal Revenue Service or submitted by the taxpayer as provided by the laws of this state…”

GA Code § 50-18-72(a)21 (2022) “Records concerning public employees that reveal the public employee’s home address, home telephone number, personal mobile or wireless telephone number, day and month of birth, social security number, insurance information, medical information, mother’s birth name, credit card information, debit card information, bank account information, account number, utility account number, password used to access his or her account, financial data and information other than compensation by a government agency, unlisted telephone number if so designated in a public record, and the identity of the public employee’s immediate family members or dependents.”