Every year, the City of Sugar Hill is required to set a millage rate. And every year since I've been observing them, they have tried to make residents think taxes were staying the same or decreasing by equating the millage rate with overall property taxes, which is inaccurate.

Many people don't know how their property taxes are calculated, because they rely on their mortgage company to pay their taxes. The City elected officials and City Manager take advantage of that situation to try to mislead people.

How Are Property Taxes Calculated

Property Taxes are calculated based on the millage rate (aka property tax rate) set by the government levying the taxes, and the value of your property.

Your property's Appraised Fair Market Value is assessed by the Gwinnett County Tax Assessor's Office. They send out an Annual Notice of Assessment to each property owner in Gwinnett every year in April, which shows that value. You can also get a copy of your Annual Notice of Assessment online from the Gwinnett County Tax Assessor's Office.

You are taxed on the Assessed Value of your property, established by Georgia Law to be 40% of your Appraised Fair Market Value. That value is also shown on your Annual Notice of Assessment.

The millage rate (aka property tax rate) is the amount you pay for each $1000 "chunk" of your assessed property value. If a government charges one (1) mill, that is $1 in tax for every thousand dollars of your assessed property value. The 2023 millage rate for Sugar Hill is 3.69 mills, which is $3.69 per thousand dollars of assessed property value. It may not sound like a lot of money when you put it that way, but as you will see, it adds up really fast.

To calculate your basic property tax:

Start with the Appraised Fair Market Value.

Multiply that value by .4 to find out your Assessed Value.

Divide the Assessed Value by 1000 to find out how many $1000 chunks are in your Assessed Value.

Multiply that number by the millage rate.

There's your property tax amount.

According to Zillow, the average home value in Sugar Hill is $442,381. Let's round up to 450,000 and use that number as an example.

Example:

Appraised Fair Market Value: 450,000

Multiply by .4 to obtain the Assessed Value: 450,000 x 0.4 = 180,000

Divide the Assessed Value by 1000: 180,000/1000 = 180

Multiply by the Millage Rate: 180 𝘅 3.69 = 664.20

Your Property Tax: $664.20

(𝙉𝙤𝙩𝙚: 𝘖𝘯 𝘵𝘢𝘹 𝘣𝘪𝘭𝘭𝘴, 𝘪𝘯𝘴𝘵𝘦𝘢𝘥 𝘰𝘧 𝘥𝘪𝘷𝘪𝘥𝘪𝘯𝘨 𝘵𝘩𝘦 A𝘴𝘴𝘦𝘴𝘴𝘦𝘥 V𝘢𝘭𝘶𝘦 𝘣𝘺 1000 𝘣𝘦𝘧𝘰𝘳𝘦 𝘮𝘶𝘭𝘵𝘪𝘱𝘭𝘺𝘪𝘯𝘨 𝘪𝘵 𝘣𝘺 𝘵𝘩𝘦 𝘮𝘪𝘭𝘭𝘢𝘨𝘦 𝘳𝘢𝘵𝘦, 𝘵𝘩𝘦𝘺 𝘰𝘧𝘵𝘦𝘯 𝘥𝘪𝘷𝘪𝘥𝘦 𝘵𝘩𝘦 𝘮𝘪𝘭𝘭𝘢𝘨𝘦 𝘳𝘢𝘵𝘦 𝘣𝘺 1000. 𝘐𝘵 𝘸𝘰𝘳𝘬𝘴 𝘰𝘶𝘵 𝘵𝘩𝘦 𝘴𝘢𝘮𝘦 𝘮𝘢𝘵𝘩𝘦𝘮𝘢𝘵𝘪𝘤𝘢𝘭𝘭𝘺.

𝘛𝘩𝘦𝘪𝘳 𝘞𝘢𝘺: (180,000 𝘅 3.69/1000) = 180,000 𝘅 .00369 = 664.20

𝘔𝘺 𝘞𝘢𝘺: (180,000/1000) 𝘅 3.69 = 180 𝘅 3.69 = 664.20

𝘐 𝘱𝘳𝘦𝘴𝘦𝘯𝘵 𝘪𝘵 𝘵𝘩𝘦 𝘸𝘢𝘺 𝘐 𝘥𝘰 𝘣𝘦𝘤𝘢𝘶𝘴𝘦 𝘐 𝘵𝘩𝘪𝘯𝘬'𝘴 𝘪𝘵'𝘴 𝘦𝘢𝘴𝘪𝘦𝘳 𝘵𝘰 𝘶𝘯𝘥𝘦𝘳𝘴𝘵𝘢𝘯𝘥.)

How Do Homestead Exemptions Work?

A Homestead Exemption reduces your home's taxable value before the tax calculation.

As of 2023, the City of Sugar Hill has three different homestead exemptions:

A general exemption of $2000 for a residential property in Sugar Hill that you own and use as your primary residence.

A senior exemption of $2000 for a residential property in Sugar Hill owned and used as a primary residence by someone 65 or older.

A low-income senior/disability exemption of $2000 for residential property in Sugar Hill owned by anyone 62+ OR disabled with a household income of less than $5000.

To calculate your property tax with a Homestead Exemption:

Start with the Appraised Fair Market Value.

Multiply that value by .4 to find out your Assessed Value.

Subtract the amount of the Homestead Exemption(s) from the Assessed Value to get the Taxable Value.

Divide the Assessed Value by 1000 to find out how many $1000 chunks are in your Assessed Value.

Multiply that number by the millage rate.

There’s your property tax amount.

Let's calculate property taxes again for the average home in Sugar Hill, using the $2000 general exemption that most people can use.

Example:

Appraised Fair Market Value: 450,000

Multiply by .4 to obtain the Assessed Value: 450,000 x 0.4 = 180,000

Subtract the Homestead Exemption(s) to get the Taxable Value:

180,000 - 2000 = 178,000Divide the Taxable Value by 1000: 178,000/1000= 178

Multiply by the Millage Rate: 178 𝘅 3.69 = 656.82

Your Property Tax: $656.82

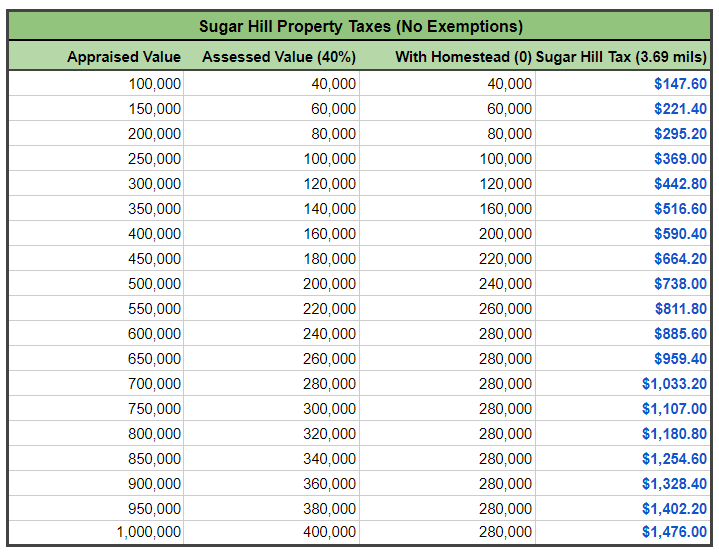

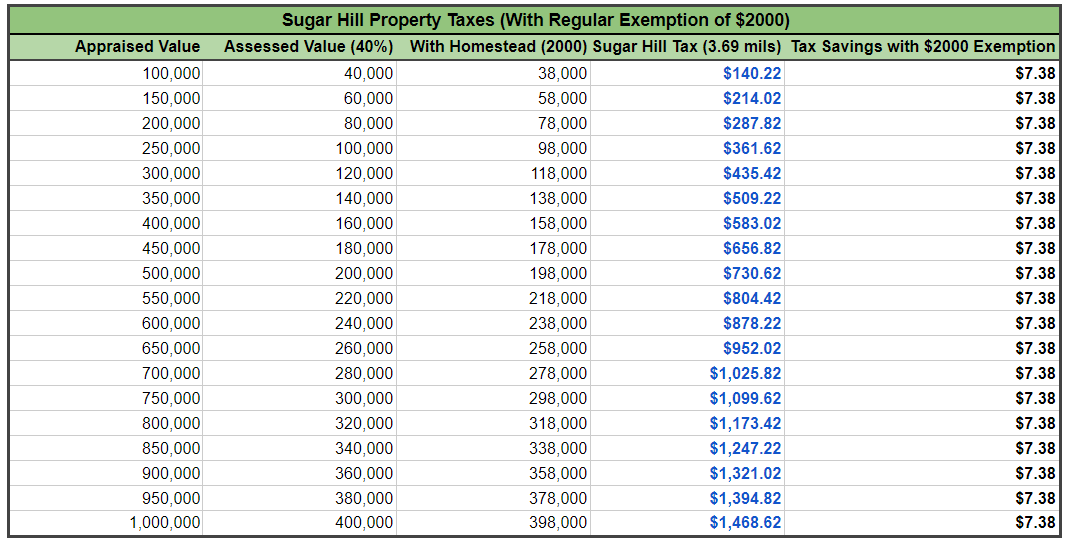

Remember, the tax without the $2000 exemption was $664.20. The $2000 Homestead Exemption used with a millage rate of 3.69 mills actually only saves you $7.38, regardless of the value of your home. (See the tables below).

The City likes to brag that the exemptions can be stacked. While most people qualify for the general exemption, fewer (less than 10% of the Sugar Hill population according to the last US Census) qualify for the senior exemption. Few qualify for the low-income disability exemption due to the income requirement. So, stacking is not beneficial to many people. The few who do qualify for all three exemptions only save a total of $22.14 (3 exemptions at $7.38 each).