Politicians, Stones, and Glass Houses

As the due date for your annual Sugar Hill property taxes just passed, and the 2022 budget is on the table, I wanted to take a deeper dive into the reasons for the change in property tax billing for those of you who might not already know. I also wanted to talk about a couple of things I found particularly interesting about it.

The Backstory (In a Nutshell)

In previous years, the Gwinnett County Tax Commissioner's office collected county taxes, as well as city taxes on behalf of Berkeley Lake, Dacula, Grayson, Lawrenceville, Lilburn, Peachtree Corners, Snellville, and Sugar Hill.

Earlier this year, newly elected Gwinnett Tax Commissioner Tiffany Porter informed cities that she intended to charge an additional $2 per parcel to collect on behalf of the cities. While government officials often like to trivialize numbers like that, it quickly adds up. The additional charge would have augmented her existing salary of $141,098 by another $110,734, making her the highest-paid elected official in Gwinnett County.

In an emailed statement shared with the AJC, Porter said, "The Gwinnett County tax commissioner is personally liable for the $1.6 billion in operations, and the law allows the tax commissioner to receive a fee personally."

Duluth, Norcross, and Loganville were already collecting their own taxes and weren't affected by the change. Lawrenceville, Lilburn, Snellville, and Sugar Hill opted to begin collecting the taxes themselves this year.

The State of Georgia later passed a law to address the situation, but probably too late to affect most cities' plans for this year. In April, the General Assembly passed a bill to have the cities negotiate fees for tax collection with the county government instead of the tax commissioner in counties with either 14 or more cities or more than 50,000 tax parcels.

Governor Kemp signed the bill in May.

The Upshot

The new law was put to the test by the City of Grayson right away. In June, the City of Grayson and Gwinnett County negotiated a tax collection contract in accordance with the new law. Under the contract, the City of Grayson would pay Gwinnett County $1.80 per parcel for the service, but not the $2 per parcel fee to Tax Commissioner Porter.

Porter still refused to collect taxes for the City of Grayson. The City sued in July.

Porter challenged the constitutionality of the new law because currently, it only affects two counties in Georgia, Gwinnett and Fulton. However, in September, a Superior Court judge ruled that Porter was indeed obligated to collect taxes for Grayson, even without payment of the additional $2 per parcel fee.

Although she initially planned to appeal the decision, Porter's office announced in late October that they would be mailing out revised tax bills starting November 1 with both the County and City tax amounts on them, with the taxes due on January 1.

So, the new law holds up so far, which means that the issue of cities paying extra money to the Gwinnett Tax Commissioner to supplement her salary is no longer an issue. If Grayson can negotiate a contract with Gwinnett that leaves that part of it out, every other city in Gwinnett should be able to do the same.

Politicians, Stones, and Glass Houses

First of all, as a citizen and taxpayer, I am disgusted with how Tax Commissioner Tiffany Porter handled the whole situation. She ran for this office in 2020, and not once during the race did she mention her intention to charge a personal fee to bill city property taxes on top of the fee paid to Gwinnett County.

Would she have been elected if she had? Maybe not. In reading through the multiple newspaper articles about this (which you can see by clicking on the links in this blog post), it seems as though her employees supported her, but not too many other people did.

But, what really struck me was the commentary from various elected officials and staff from Gwinnett County and different cities in Gwinnett. Some of them really seemed to enjoy the chance to dunk on another elected official for making a fat personal profit off the public in an ugly and unethical, albeit completely legal, way.

We can all hope their criticism of Tiffany Porter originated from a strong sense of ethics and genuine disgust for unbecoming behavior in office. But, I was not impressed. Criticizing another government official doesn't magically make them any better. It smacks of the cheap posturing you see most often at the federal level.

The truth is, ALL elected officials and government employees need to be under the watchful eye of the PUBLIC. That's the only way to ensure that the public's interests are well served. Honorable government officials would agree, and would welcome (perhaps encourage) public oversight and inspection, not just for their colleagues, but also for themselves.

In my observation and experience as a watchdog, few government entities welcome that oversight and inspection. More often than not, they work pretty hard to dodge it.

Putting Sugar Hill to the Test

I was interested in the costs incurred by Sugar Hill taxpayers to move the city tax billing and reached out to Sugar Hill City Manager Paul Radford back in July for more information. I specifically asked to see some kind of cost analysis so we could see for ourselves that the change made sense. Basic questions about a topic that's everyone's business.

The Response

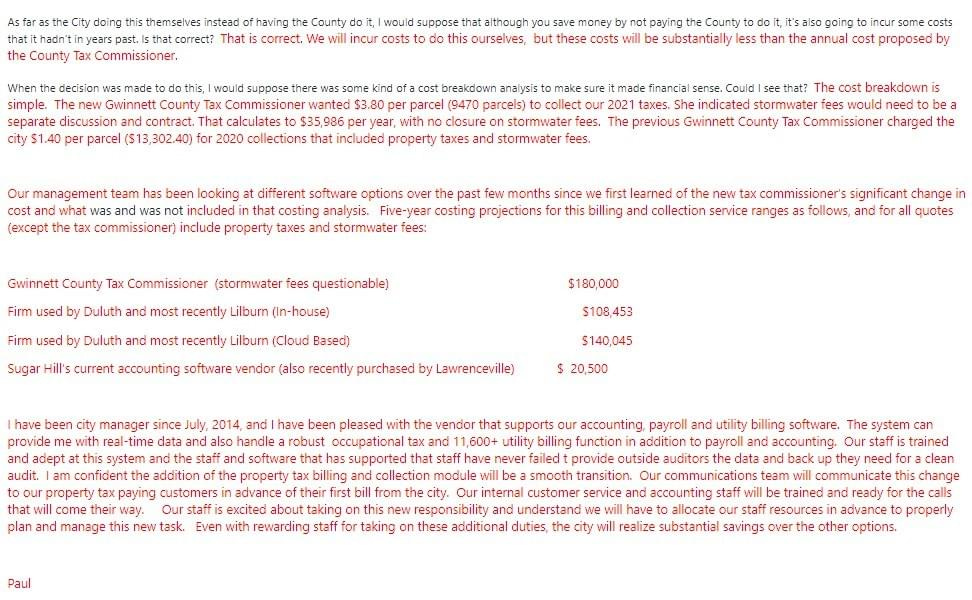

He provided detailed info about the County's costs that I could verify through reports from the Gwinnett Daily Post and AJC. None of the financial information was contested by the Tax Commissioner. It's easy to follow the math from there and everything checks out.

After that, I detected an effort to obfuscate information. When I said I wanted to SEE the cost analysis, I meant that I wanted to see any presentations, price quotes, or reports City staff shared with the Mayor and Council. What I got was an explanation with some holes in it. Perhaps there were no presentations, price quotes, or reports. But, there should have been. The Mayor and Council should have required that before making a decision.

His explanation included some information about 5-year cost projections using some other firms. This information is pretty meaningless, considering there's no way anyone can verify the numbers because he didn't share proof of the price quote from the vendor, or even the NAME of the vendor. If he was unable to share that information, he should not have shared the numbers.

He also shares a 5-year cost projection using Sugar Hill's current accounting software, which he also doesn't specifically name. While it is reasonable that the prices are different, the massive price difference with no supporting information strikes me as being off. Is the company used by Duluth and Lilburn providing billing services, or just software? If it is just software, then why are those numbers SO much higher than Sugar Hill's vendor? It made me wonder if he was sharing the cost of the entire software package for Duluth and Lilburn, and just the cost of the property tax billing and collection module for Sugar Hill, which would not be an accurate comparison.

Sharing these numbers seems intended to paint the City's choice in a better light. But, a better light wasn't necessary if the City was really saving taxpayers money. It was a pointless road to go down. Given that the numbers are vague and unsubstantiated, it ended up casting doubt on the response.

Vulnerable Glassy Spots in Sugar Hill's House

What I found most interesting was his statement at the end of the email.

"Our staff is excited about taking on this new responsibility and understand we will have to allocate our staff resources in advance to properly plan and manage this new task. Even with rewarding staff for taking on these additional duties, the city will realize substantial savings over the other options."

It seems odd that the City now believes the task warrants extra pay. They criticized the Gwinnett County Tax Commissioner and took the task away from her when she said it was worth extra pay.

Radford didn't mention how much these staff rewards would be so everyone could make their own calculations to verify that we would indeed save money when that cost was included. If it wasn't very much money, why not just give a dollar amount so people could see that for themselves?

City officials have a bad habit of glossing over "little" details like that.

It's a habit that erodes trust.

In Conclusion...

I'm not saying that the City of Sugar Hill was behaving anywhere near as badly as the Tax Commissioner in this scenario. My suspicion is that the City probably is saving the taxpayers money, which is a good thing.

However, I also suspect they're not saving us as much as they'd like to claim. And, it is pretty hard to ignore that there was some runaround when I asked about it, and I never got a clear answer. Runaround is never a good thing, and always a sign that something is off.

Could I have asked follow-up questions? Yes. But people who direct the expenditure of millions of dollars in taxpayer funds ought to lead with their best response. They shouldn't make residents drag it out of them. And, if they're doing what they are supposed to, the response would include clear, provable information.

Trust is earned. It is not an entitlement. Especially not for the government. Of course, they'll say they're on the up and up and acting in our best interest. We need to see it.

Perhaps, they just don't know how to deal with public oversight and inspection. Maybe they just think they're above it all. It's hard to say.

One thing is certain. Government officials need to be as quick to seek out and critique their own failures as they are to speak out on someone else's, because the public is the ultimate judge of who's serving us well.