Eight Steps to the Solis Sugar Hill Tax Break

Developer Terwilliger Pappas, builder of the approximately 300-unit Solis Sugar Hill apartment complex next to City Hall, is receiving a 15-year property tax break through a bond-lease (Bonds for Title) agreement with the City’s Downtown Development Authority (DDA).

As of January 1 of this year, the complex was only partially complete but already valued just shy of $45 million by the Gwinnett County Tax Assessors Office. However, the developer will pay $0 in Gwinnett County Property Taxes and $0 in Sugar Hill property taxes this year. This will save the North Carolina-based company $629,606.59 and $66,378.52, respectively, for a grand total of $695,985 in just this second year of this deal.

I witnessed the meetings where this deal was discussed, and asked questions of City staff. I did not receive answers to my questions. I submitted an Open Records Request (ORR) to get the agreements for this deal. The City only gave me six (6) of the documents responsive to that ORR. As I read through them, I saw other documents mentioned that would have also been responsive to the ORR, and had to request them separately.

It is exceedingly clear that the City did not want me to know about this deal, because they did not want YOU to know about this deal. That alone says a lot about the City’s estimation of how good this deal is for you.

This is a thorough layman’s summary of the deal that led to the Solis Sugar Hill tax abatement. I keep this simple on purpose. I’m not a lawyer and do not claim to be, but I can read a contract, understand the basic ideas it presents, and have a reasonable idea of whether I’d sign it or not. That’s the same level of expertise as the City Council and DDA who approved and signed these agreements. They have attorneys who draw these agreements up, and attorneys who review them. That means it’s legal. It doesn’t necessarily mean it was the best thing to do or that it’s a great deal for taxpayers, whose interests and goals may diverge from those of the government officials who hire the attorneys.

To keep it simple, I say “City” to mean either the City of Sugar Hill or the City of Sugar Hill Downtown Development Authority (DDA) because the DDA does not act without approval from the City Council. Ultimately, the entire City Council at the time (including Jennifer Thatcher and Mason Roszel in their first month of office) voted to approve the bond that is a centerpiece of this arrangement.

Basically, the whole deal went down like this:

The City spent $2,774,380 in taxpayer money between 2012 and 2015 to acquire privately owned land where Solis Sugar Hill now stands.

They overpaid by a little more than 78% for all the parcels when you look at the appraised market values when the parcels were purchased.

The City then sat on that now public land, with neither the County nor the City drawing tax revenue from the property.

The City agreed to issue a $7.716 million bond to help pay for the project's construction.

The City will maintain ownership of the property and now the title to this project for 15 years. However, the developer gets to use the land and building as though it is theirs - a usufruct. During this time, the property is tax-exempt and the developer does not pay property tax to either Gwinnett County or the City of Sugar Hill.

The developer leases the property from the City.

The developer’s lease payments are supposed to cover the principal, premium (if any), and interest for the bonds.

The City of Sugar Hill has agreed to levy up to 3 mils (or the maximum allowed by law if that ever changes) if necessary to meet the bond repayment obligation.

The City will also charge what it calls an “administrative fee,” more commonly referred to as a Payment in Lieu of Tax (PILOT).

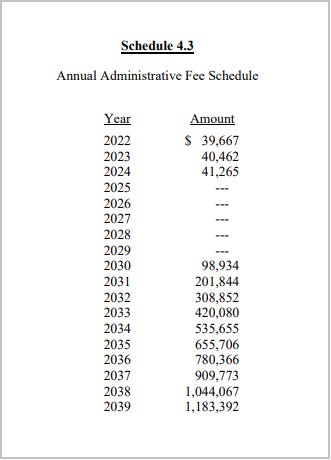

Often in these deals, and early in the discussions for this one, the PILOT is defined as a percentage of what the company would have paid in property tax. Our final agreement with this developer sets the PILOT portion of the lease payments as specified dollar amounts according to this schedule from the Design, Development, and Occupancy Agreements between the City and developer:In the first three years of the deal (2022, 2023, and 2024), the City will make $121,394 in administrative fees. The developer would have paid $1452.36 in City property tax last year, and $66,378.52 in City property taxes this year. Let’s (conservatively) estimate a Sugar Hill 2024 property tax amount of $100,000 using The Local’s 2023 property taxes as a measure. That’s $167,830.88 ($46,437 more than the admin fees) that the City could have made in property taxes in the first three years of this deal.

After that, the developer gets FIVE (5) years without ANY property taxes OR administrative fees. In year 6, administrative fees are back, but less than the City would make in property taxes. In 2031 (year 9 of the deal), the City is poised to make more in administrative fees than they do in property taxes.Gwinnett County receives none of the PILOT money and loses millions of dollars in tax revenue (to be made up elsewhere), all while providing police, fire and EMS, and in some cases schools for around 300 extra residents.

The first lease payment from the developer was $5 million, designed to be a land payment. The politicians will probably try to claim they made a profit of $2,225,620 off of the land to make this deal sound better. But, ANY profit on the land sale doesn’t really matter BECAUSE…

The City immediately takes $4.95 million from that $5 million to pay for 350 parking spaces, none of which are exclusively for public use.

One hundred fifty (150) parking spaces will be shared for private and public use. The public is only allowed to use the shared spaces from 9AM - 5PM, Monday through Friday. On nights and weekends, the shared spaces are exclusively for apartment residents. There are already signs in those spaces stating that towing is strictly enforced, clearly intended to make sure the public vacates the spots during nights and weekends. There is no signage indicating that apartment residents must free up the spaces for public use during the daytime.

Two hundred (200) parking spaces are for public use, but there is nothing to prevent apartment residents from using them. So in practice, those spaces are also shared.

According to the agreements, the City is getting 12,001 square feet of commercial space for nothing when they get the parking spaces. Kind of an expensive BOGO. The spaces will be pretty bare-bones when we get them. If the City does the same thing here as it did with the E Center spaces, it will pay the costs of building them out.

The City revealed at its September DDA meeting that they plan to rent one of the retail spaces to Playa Bowls and another to Starbucks, which introduces new close competition with the other coffee shop (Rushing Trading) leasing City-owned space.

The main question remains. Is this a good deal?

It depends on who you’re talking about.

Terwilliger Pappas is a private company. They must focus on profits to stay in business. They aren’t going to participate in an arrangement that does not benefit them financially. Even with the administrative fees to the City of Sugar Hill, they save a LOT of money because they are getting out of Gwinnett County property taxes. If they ever decide they are not saving enough, their agreement with the City does allow them to pay the lease early. They are the real winners here.

The City of Sugar Hill government loses money on the front end of the deal, even accounting for “administrative fees.” Nine (9) years into the deal, the government does stand to make significantly more money in administrative fees than they would have in property taxes, if the developer doesn’t repay the bond early. Either way, they get 294 more apartment units in their “Downtown,” and the chance to use your money to pretend they are real estate tycoons.

The Gwinnett County government is already well on its way to losing a million dollars in tax revenue and stands to lose millions more due to the City’s deal. Will the County cut spending, or keep spending and make up the revenue shortfall somewhere else? Every thinking person knows how that works. And it matters. Every Sugar Hill taxpayer is also a Gwinnett County taxpayer.

Speaking of Sugar Hill taxpayers, how do they fare in this deal overall? Well, we’re getting some shared parking spaces for $4.95 million. And a Starbucks. Will your City government lower your taxes if/when it makes money here? Probably not. Extra tax revenue equals extra spending in the big government mindset. The City couldn't even bring itself to cut YOUR taxes in a very contentious election year.

What will your government spend the money on? Overpriced land purchases for more deals like this one? A trolley? Maintenance on the Greenway (because they didn’t account for the lifetime of maintenance on that when they sold it to you)? Who knows? I can assure you that whatever it is, it’ll probably be in the “Downtown” and you won’t get a say in it.