The City of Sugar Hill conducted the last in a series of three public hearings at the August City Council Meeting on Monday, August 14. City Council subsequently set the millage rate to 3.69 mills for the 2023 tax year.

The City had been using a millage rate of 3.8 mills for the previous twenty years. The Mayor, Council, and City Manager bragged about the millage rate reduction, at times incorrectly referring to it as “the rollback rate”, which is legally defined by the State of Georgia as “the previous year’s millage rate MINUS the millage equivalent of the total net assessed value added by reassessments.“ In plain English, it’s the millage rate that would result in the City receiving the same property tax revenue as the previous year from the existing, unimproved properties in the tax digest (list of taxable properties). This year’s Rollback Rate was actually 3.409 mills.

True to their tradition of trickery, the City again left out a critical point in their taxation discussion: the property tax rate is only one part of your property tax calculation. And there were some huge changes to property values again this year.

Of the 9033 total properties in Sugar Hill, 71% increased in value.

While City Manager Paul Radford crowed about the decrease in single-family residential properties as a percentage of Sugar Hill’s overall tax digest during the public hearings, an examination of the parcels in the City indicates that the change is not so much a shift from residential to commercial, but primarily from the conversion of single-family residential properties into townhome properties.

Single-family homes still account for 76% of the properties in Sugar Hill. About 77% of the single-family homes increased in value this year, by an average of 20%. Townhouses are now the second-highest property type in Sugar Hill, accounting for 10% of the properties in the City. About 64% of the townhomes also increased in value this year, by an average of 18%.

(𝘕𝘖𝘛𝘌: 𝘞𝘩𝘦𝘯 𝘐 𝘤𝘢𝘭𝘤𝘶𝘭𝘢𝘵𝘦𝘥 𝘵𝘩𝘦 𝘢𝘷𝘦𝘳𝘢𝘨𝘦 𝘷𝘢𝘭𝘶𝘦 𝘪𝘯𝘤𝘳𝘦𝘢𝘴𝘦𝘴 𝘧𝘰𝘳 𝘴𝘪𝘯𝘨𝘭𝘦-𝘧𝘢𝘮𝘪𝘭𝘺 𝘩𝘰𝘮𝘦𝘴 𝘢𝘯𝘥 𝘵𝘰𝘸𝘯𝘩𝘰𝘮𝘦𝘴, 𝘐 𝘰𝘯𝘭𝘺 𝘤𝘰𝘶𝘯𝘵𝘦𝘥 𝘵𝘩𝘦 𝘱𝘳𝘰𝘱𝘦𝘳𝘵𝘪𝘦𝘴 𝘵𝘩𝘢𝘵 𝘸𝘦𝘳𝘦 𝘰𝘯 𝘵𝘩𝘦 𝘳𝘦𝘤𝘰𝘳𝘥 𝘢𝘯𝘥 𝘱𝘢𝘪𝘥 𝘱𝘳𝘰𝘱𝘦𝘳𝘵𝘺 𝘵𝘢𝘹 𝘭𝘢𝘴𝘵 𝘺𝘦𝘢𝘳, 𝘕𝘖𝘛 𝘵𝘩𝘦 𝘯𝘦𝘸 𝘱𝘳𝘰𝘱𝘦𝘳𝘵𝘪𝘦𝘴 𝘵𝘩𝘢𝘵 𝘸𝘪𝘭𝘭 𝘣𝘦 𝘱𝘢𝘺𝘪𝘯𝘨 𝘧𝘰𝘳 𝘵𝘩𝘦 𝘧𝘪𝘳𝘴𝘵 𝘵𝘪𝘮𝘦 𝘵𝘩𝘪𝘴 𝘺𝘦𝘢𝘳. 𝘐 𝘢𝘭𝘴𝘰 𝘥𝘪𝘥 𝘯𝘰𝘵 𝘤𝘰𝘶𝘯𝘵 𝘵𝘩𝘦 𝘱𝘳𝘰𝘱𝘦𝘳𝘵𝘪𝘦𝘴 𝘸𝘩𝘰𝘴𝘦 𝘷𝘢𝘭𝘶𝘦 𝘪𝘯𝘤𝘳𝘦𝘢𝘴𝘦𝘥 𝘣𝘦𝘤𝘢𝘶𝘴𝘦 𝘢 𝘣𝘶𝘪𝘭𝘥𝘪𝘯𝘨 𝘸𝘢𝘴 𝘤𝘩𝘢𝘯𝘨𝘦𝘥, 𝘢𝘥𝘥𝘦𝘥, 𝘰𝘳 𝘶𝘱𝘥𝘢𝘵𝘦𝘥.)

The rising property values are happening throughout the area, and have nothing to do with the City of Sugar Hill, a fact that the Mayor, Council, and City Manager both embrace (when trying to claim that rising property values are good for you and the result of their “Downtown” initiative) and deny (when trying to deflect responsibility for the tax increase), depending on what corner they find themselves backed into at the moment.

The fact is, property values are going up everywhere, not as the result of anything the City does or does not do. Rising property values only benefit you if you sell your property and move somewhere with lower property values, which is hard to find these days. However, the City of Sugar Hill is VERY aware of the property values. Gwinnett County provides them to the City so the City can calculate its Rollback Rate and projected tax revenue at the proposed millage rate. The City knows EXACTLY what will happen to taxpayers at their proposed rate, and have ample time to calculate how low they can go without messing up the City’s finances.

Because the property values increased so much AND 3.69 is NOT the full Rollback Rate, the reduced millage rate of 3.69 mils still allows the City to take in a projected 13.45% MORE tax revenue than last year. If they had left the millage rate at 3.8, they would have taken in 16.83% more tax revenue. The 2023 millage rate reduction isn’t a tax cut. It is simply raising your taxes by slightly less than they could have.

The State of Georgia requires local governments to advertise their tax revenue increases as the tax increases that they are, and hold three public hearings prior to setting the millage rate that results in an increase. The City was required to hold the hearings again this year, just as they have every year since at least 2019, when I started observing the City of Sugar Hill government.

This tax revenue increase comes right after last year’s massive 28.16% increase in tax revenue for the City of Sugar Hill. No one from the City mentioned that or seemed to remember it when residents brought it up during the second millage rate hearing the week before.

Increasing tax revenue 13.45% right after increasing it 28.16% means that in the past two years, the City of Sugar Hill has increased its tax revenue 45.40%. As you can imagine, no one from the City mentioned that, either.

Want to see the data from Gwinnett County Tax Assessors’ Office and my calculations for yourself? Go to Sugar Hill Property Data and Analysis - 2023 and Sugar Hill Tax Math.

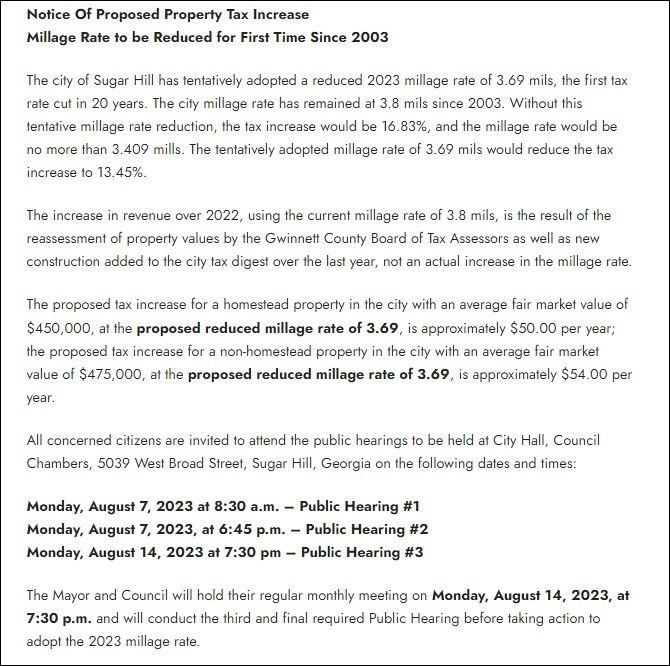

Official Notice of Proposed Property Tax Increase from the City of Sugar Hill

The City of Sugar Hill wrote this ad to advertise the increase in property taxes this year, as required by Georgia Law. The law specifies some of what they have to say in this ad, but also allows some leeway on the wording. The City uses the leeway to bluster and mislead people about what’s going on. Or perhaps they’re just really bad writers.

A tax RATE CUT is NOT the same as a TAX CUT, that’s why they’re required to publish this notice and run it as an ad in the newspaper.

And, the tax increases ARE the sole responsibility of the City of Sugar Hill. The Gwinnett Tax Assessors simply record values based on fair market data. The City adjusts its millage rate for the amount of tax revenue it needs or wants.

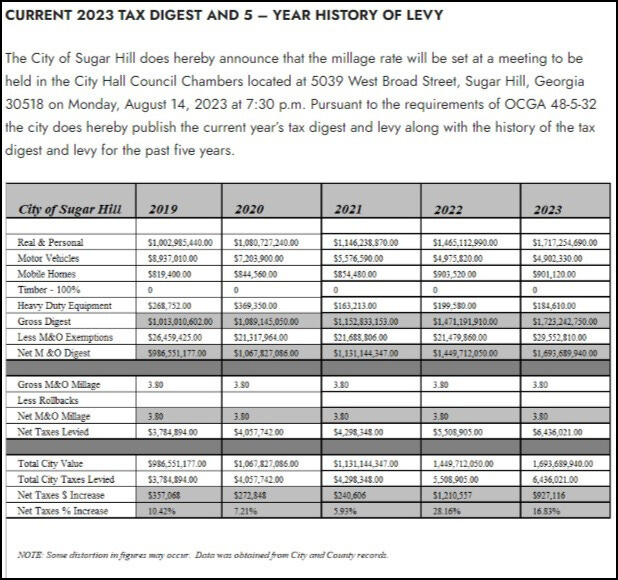

2023 Tax Digest and 5-Year History of Tax Revenue

The 2023 Tax Digest (taxable properties) within the City of Sugar Hill and the history of tax levy (aka tax revenue). Look a little blurry? It comes from the City that way EVERY YEAR. They are required by law to create this chart and publish it at a certain size in the newspaper. They’re just not legally required to make it easy to read.

2023 Tax Digest and 5-Year History of Tax Revenue

I made a better copy of this table so you can easily read it.